Limited Partnership Opportunities

Interested in Limited Partnership Opportunities?

Why we love this deal:

- 20 Class A, new-build single-family houses are being purchased through partnerships with best-in-class homebuilders in suburban markets of Memphis

- Highly favorable risk-adjusted return and cash flow profile without any development or renovation risk

- Investors will benefit from significant equity value creation at transaction close as assets are being purchased at a substantial discount

- Houses will be leased and managed by Reedy & Company, who has had a considerable amount of success with leasing and managing comparable assets

Offering summary:

- Average Annual Return: 12.5% - 13.5%

- Total ROI: 130%

- IRR: 11.0% - 12.0%

- IRR (including tax benefits) 12.0% - 13.0%

- Cash flow yield: 7.0% - 8.0%

- Cash flow yield (including tax benefits): 9.5% - 10.5%

- Cash flow distributions: Monthly distributions beginning in the summer of 2025

- Risk profile: Core

- Closing at receipt of Certificate of Occupancy (no development or renovation risk is being incurred)

- Return profile: Core Plus

- Minimum investment: $50,000

- Offering size: ~$3mm

- Hold period: ~10 years

- Strategy: Long-term buy-and-hold with flexibility to be opportunistic

- Accredited investors only

- Funding deadline: 2/27/2025

- This investment is available on a first come, first serve basis

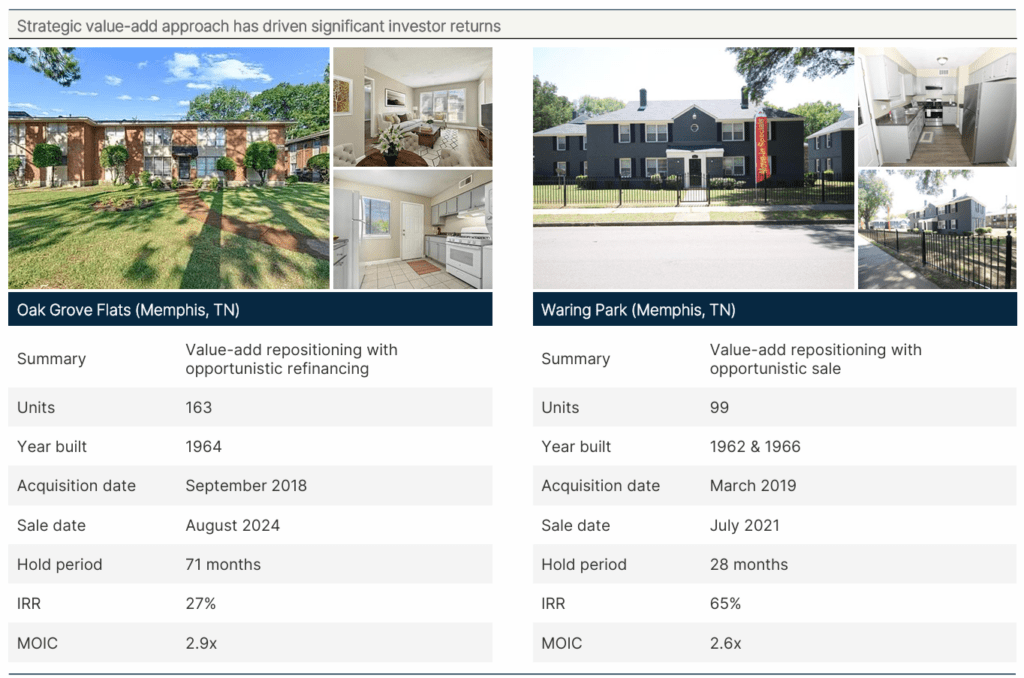

Exited Multifamily Investments

⭐️⭐️⭐️⭐️⭐️

“I have been a longtime single-family investor of MIPs and have invested in all of their LP Offerings. The Reedy family and Mark have outperformed on their deals, one of which is getting over a 50% annual cash flow yield! I like how they have conservative underwriting with a high upside potential"

- Jerry

Memphis Investment Properties

Questions? Call 901-244-5820

Disclaimer

The following information is an investment summary provided to prospective investors and others. This information is not an offering to sell either a security or a solicitation to sell a security. At the request of a recipient, MIP Capital Partners ("Manager") will provide a private placement memorandum, subscription agreement, and the Limited Liability Company Operating Agreement. MIP Capital Partners in no way guarantees the projections contained herein. Real estate values, income, expenses, and development costs are all affected by a multitude of forces outside the Company’s control. This investment is illiquid and only those persons that are able and willing to risk their entire investment should participate. Please consult your attorney, CPA, and/or professional financial advisor regarding the suitability of an investment by you.

Certain statements contained in this summary, including, without limitation, statements containing the words “believes,” “plans,” “expects,” “anticipates,” “projects,” and words of similar import, constitute “forward-looking statements” within the meaning of safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon the current beliefs and expectations of the Manager but are subject to significant known and unknown risks, uncertainties, and other factors, including without limitation, the risk factors set forth in the offering documents, which may cause the actual results, performance or achievements of the Manager, and its affiliates, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Undue reliance should not be placed on these forward-looking statements, and if underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in (or implied by) these forward-looking statements. The Manager disclaims any obligation to update any of the contents of this summary or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments except as required by applicable law.

This summary, and all of the contents hereof, are confidential. No right of publication or disclosure of this summary (or any of the contents hereof) is given to the initial recipient to any other party. This summary does not contain all of the details and/or information necessary or desirable for an investor to make a decision or evaluation of an investment in the offering. The Manager does not take responsibility for the accuracy or the completeness of any information contained herein which was obtained from third-party sources and makes no assurances therefore. In addition, the information contained in this summary is based on unaudited accounts. This summary is not and does not purport to be, an appraisal of the assets, stock, or business referenced herein. Neither this summary nor any of its contents may be used for any other purpose without the prior written consent of the Manager.

An investment in real estate involves complex U.S. federal, state and local income tax considerations that will differ for each Member. Prospective investors should consult with their own tax advisors regarding any U.S. federal, state and local tax impacts.